The most crucial SDIRA policies through the IRS that investors will need to be familiar with are investment limitations, disqualified folks, and prohibited transactions. Account holders need to abide by SDIRA rules and rules so as to preserve the tax-advantaged position of their account.

Have the freedom to invest in Practically any sort of asset which has a danger profile that fits your investment technique; like assets which have the potential for the next fee of return.

And since some SDIRAs for example self-directed common IRAs are issue to required minimal distributions (RMDs), you’ll should program in advance making sure that you've got ample liquidity to satisfy The principles set from the IRS.

In advance of opening an SDIRA, it’s imperative that you weigh the opportunity advantages and disadvantages dependant on your specific money targets and risk tolerance.

Criminals in some cases prey on SDIRA holders; encouraging them to open accounts for the objective of creating fraudulent investments. They generally fool investors by telling them that When the investment is approved by a self-directed IRA custodian, it should be legit, which isn’t accurate. Yet again, Make sure you do thorough research on all investments you select.

Put only, when you’re trying to find a tax efficient way to develop a portfolio that’s a lot more tailored on your interests and expertise, an SDIRA may very well be the answer.

SDIRAs are often utilized by arms-on investors that are prepared to take on the challenges and duties of choosing and vetting their investments. Self directed IRA accounts can be perfect for buyers that have specialised awareness in a niche industry they would want to spend money on.

Including money directly to your account. Understand that contributions are matter to annual IRA contribution limits established via the IRS.

An SDIRA custodian is different since they have the right staff members, knowledge, and capacity to keep up custody with the alternative investments. The first step in opening a self-directed IRA is to locate a provider that may be specialized in administering accounts for alternative investments.

Believe your Buddy could be commencing the next Fb or Uber? By having an SDIRA, you could put money into brings about that you believe in; and possibly appreciate higher returns.

Certainly, real estate property is one of our clients’ most favored investments, at times known as a housing IRA. Clientele have the option to invest in anything from rental Qualities, business property, undeveloped land, property finance loan notes and much more.

Ease of Use and Engineering: A consumer-helpful System with on the net applications to trace your investments, post paperwork, and deal with your account is important.

Better Costs: SDIRAs frequently have better administrative fees in comparison with other IRAs, as selected elements of the executive system cannot be automated.

This incorporates being familiar with IRS regulations, managing investments, and staying away from prohibited transactions that might disqualify your IRA. A lack of knowledge could result in costly mistakes.

No, You can not spend money on your own personal business having a self-directed IRA. The click site IRS prohibits any transactions between your IRA plus your individual organization because you, given that the proprietor, are considered a disqualified man or woman.

The tax advantages are what make SDIRAs appealing for many. An SDIRA can be equally standard or Roth - the account sort you decide on will count largely on your investment and tax system. Test using your economic advisor or tax advisor if you’re Not sure which can be best in your case.

Schwab gives a number of retirement strategies for small corporations, regardless of whether your business employs 1 or quite a few.

Contrary to shares and bonds, alternative assets tend to be harder to market or can come with go to this web-site stringent contracts and schedules.

A self-directed IRA is undoubtedly an amazingly effective investment car, but it’s not for everybody. Because the saying goes: with good electrical power will come fantastic more information duty; and having an SDIRA, that couldn’t be a lot more genuine. Continue reading to find out why an SDIRA may well, or may not, be for yourself.

Opening an SDIRA can give you entry to investments normally unavailable through a lender or brokerage firm. Below’s how to begin:

Taran Noah Smith Then & Now!

Taran Noah Smith Then & Now! Val Kilmer Then & Now!

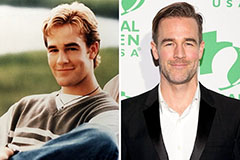

Val Kilmer Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Mason Reese Then & Now!

Mason Reese Then & Now! Soleil Moon Frye Then & Now!

Soleil Moon Frye Then & Now!